About AXA

AXA is an insurance company that is continuously striving to make people’s lives better and safer. They work tirelessly to innovate, supporting startups and new healthcare technology, while pushing boundaries and challenging the status quo. AXA employees drive that forward-thinking mentality. They put their customer first and work together to build a data-driven company. To equip them to do their best and help future-proof the company, AXA focuses on giving their people the skills and capabilities they need.

The challenge

Data is crucial to any insurance business, and so is the tech those businesses use to leverage data and predict customer demand. AXA, therefore, needed to do their best to put that data at the core of what they do, particularly for their learning and development framework. AXA wanted to properly invest in an apprenticeship programme for their employees who hadn’t previously received formal training in data analytics. They also wanted to teach those employees how to use these new techniques and transform not only the way they do their jobs, but how they think about the data they have access to. Apart from a key goal of improving customer outcomes, AXA’s other mission was to drive a cultural change and build a more insight-led, data-driven organisation. For AXA, all of this would future-proof their workforce, and by extension, the entire organisation.

The solution

To help effectively train their people, AXA invested more than £800,000 in a brand-new data academy. Employees were able to actively apply what they’d learned in their day-to-day roles, thanks to the apprenticeship-based programme and training provided by Avado. So far, 54 AXA employees aged between 22 and 55 were given access to the company’s latest technology and assets. With that access, they were able to develop their skillsets with Level 4 Data Analytics Apprenticeships. The organisation is now the first insurer to build a data academy that spans across all functions, which is an accomplishment for both AXA and Avado. Each apprentice used real-world scenarios and reporting tools to apply their new skills. For example, employees in underwriting worked on new ways of calculating risk and detecting fraud, while people in HR were able to better understand employee dynamics. Providing this programme across the entire company means that employees from all areas of the business are now able to practice responsible use of data. With those data innovations happening everywhere, AXA expects a culture of data-first thinking to thrive.

What success looked like

A total of 47 AXA employees are currently enrolled in two different apprenticeship programmes: Data Analysis Concepts and Data Analysis Tools. Each of those employees will not only be implementing new data technology, but they will also be AXA data champions. That means they’ll help others in the organisation make the most of data, as well.

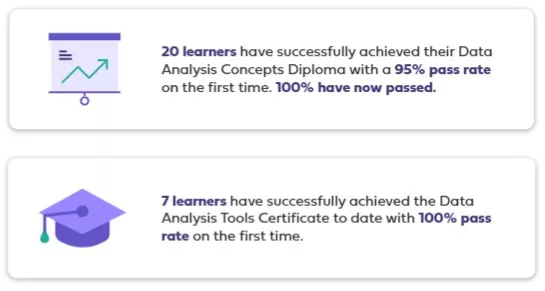

Of the 47 AXA employees who are currently enrolled:

From our AXA learners

“I have always been very career-focused, so I was initially unsure how the course would fit within my day-to-day role. I currently work part-time whilst balancing caring responsibilities. However, the 20% off-the-job learning within working hours has enabled me to incorporate study into my working week. With the support of the training provider and my manager, and by utilising remote learning, I am able to juggle work, home and apprenticeship life really well.” — Harriet Schofield, Risk & Compliance Analyst & Data Analytics Apprentice, AXA Insurance, Morecambe

“An apprenticeship was an opportunity for me to retrain within a different field whilst also learning on the job. I get the chance to work in an environment with real data sets whilst also learning and developing analysis methods.” — Rhian Williams, Data Scientist, AXA Health, Tunbridge Wells

“As an external claims auditor, being able to utilise the data available will allow me to identify potential problems. I can then turn these insights into meaningful actions to support the business. I have found the apprenticeship to be one of the best choices for personal development that I have made.” — Shaun Dale, Senior Claims Auditor & Data Analytics Apprentice, AXA Insurance, Bolton

4 min read

4 min read